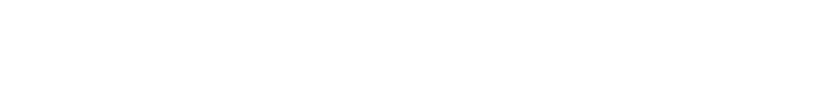

Portal Access Through VTHR Home Page Tiles Beginning November 1, 2024

Download Instructions for Open Enrollment Online

Retired Employees Enrollment Form [pdf]

Note: If you are a new employee and within 60 days of your date of hire, email DHR.Benefits@vermont.gov if you want to enroll in coverage that begins before January 1, 2025.

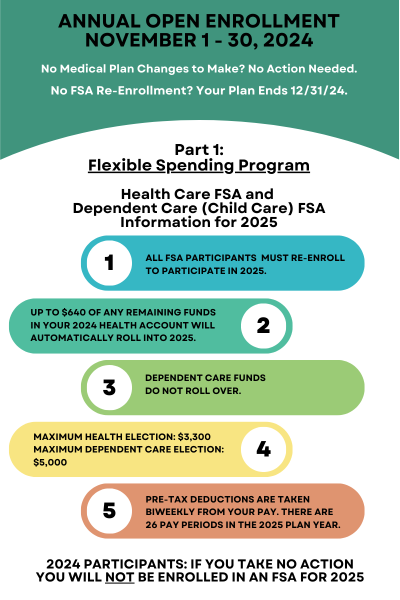

2025 Premium Rate Information (VSEA review in process)

Active Employees 2025 Health Benefits Premium Chart [pdf]

Retired Employees 2025 Health Benefits Premium Chart [pdf]

2025 State of Vermont Employee Benefits Guide [pdf]

If you are adding a domestic partner, submit this form no later than Nov. 30, 2024 to DHR.Benefits@vermont.gov after you've completed the online process:

Domestic Partner Application

This is also a good time to check the data for any dependents on your health plan to verify it is correct (name spelling, date of birth, SSN).

Life Insurance

There will be a decrease in the employee share premium - from $.03210 per $1,000 of coverage, to $.02755 per $1,000 of coverage

To check on your identified beneficiaries, call Securian/Minnesota Life at 866-293-6047 or login to your account at lifebenefits.com

For your retirement benefits beneficiaries: Retirement Office: Tre.RetirementDivision@vermont.gov, 802-828-2305

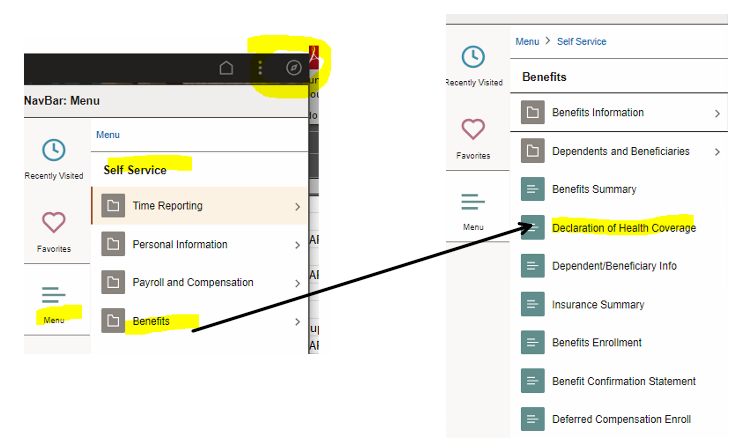

Declaration of Health Insurance Coverage

If you are an active employee and you are eligible to enroll in the State Employees’ Health Plan but have other health insurance coverage, you are required to submit a Declaration of Health Insurance Coverage Form, which is done online in VTHR: